Exit strategies and Covid-19: what’s the deal?

In the first months of 2020, startup ecosystems globally felt the ripple effect of the pandemic, with a high percentage of the tech sector poised to starve in the coming months. Simultaneous drop in consumer demand and VC Investment are leading to a serious capital crunch and as restart timelines remain unclear, time-to-exit keeps rising for most tech startups.

What are the winning strategies to build a steady growth in such an uncertain time? Will the creation of distributed team hubs be a necessary step toward successful scalability?

Recent trends in the exit strategy landscape and the impact of COVID-19

The pandemic has surely slowed or paused the pace and pricing of IPOs. However, way before COVID-19 made its appearance, several were the unicorn over-hyped valuations that very publicly burned investors. The 2019 business landscape alone can count with popular cases such as WeWork’s failed IPO and Uber and Lyft’s rough ride on the public market. All these examples forced investors to look more carefully at sustainable advantage, barriers to entry and generally at companies’ de-risking plans.

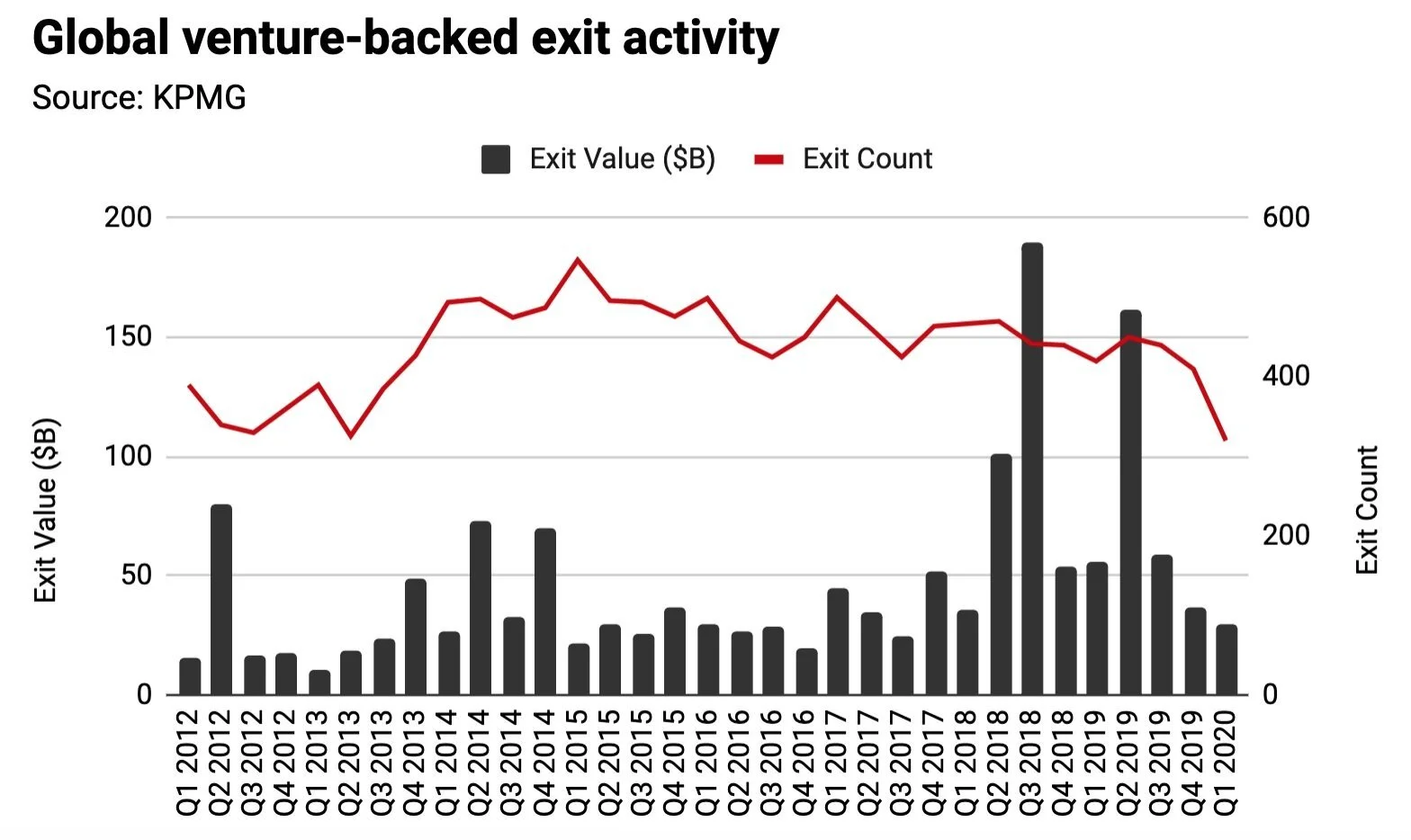

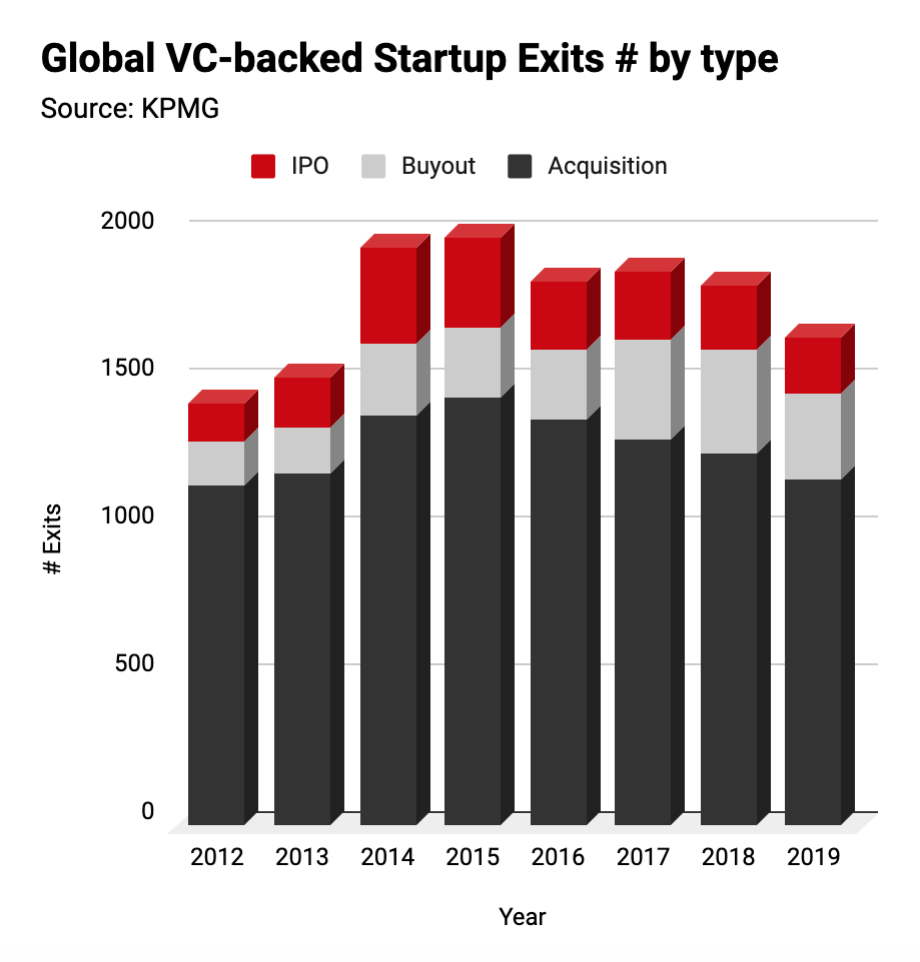

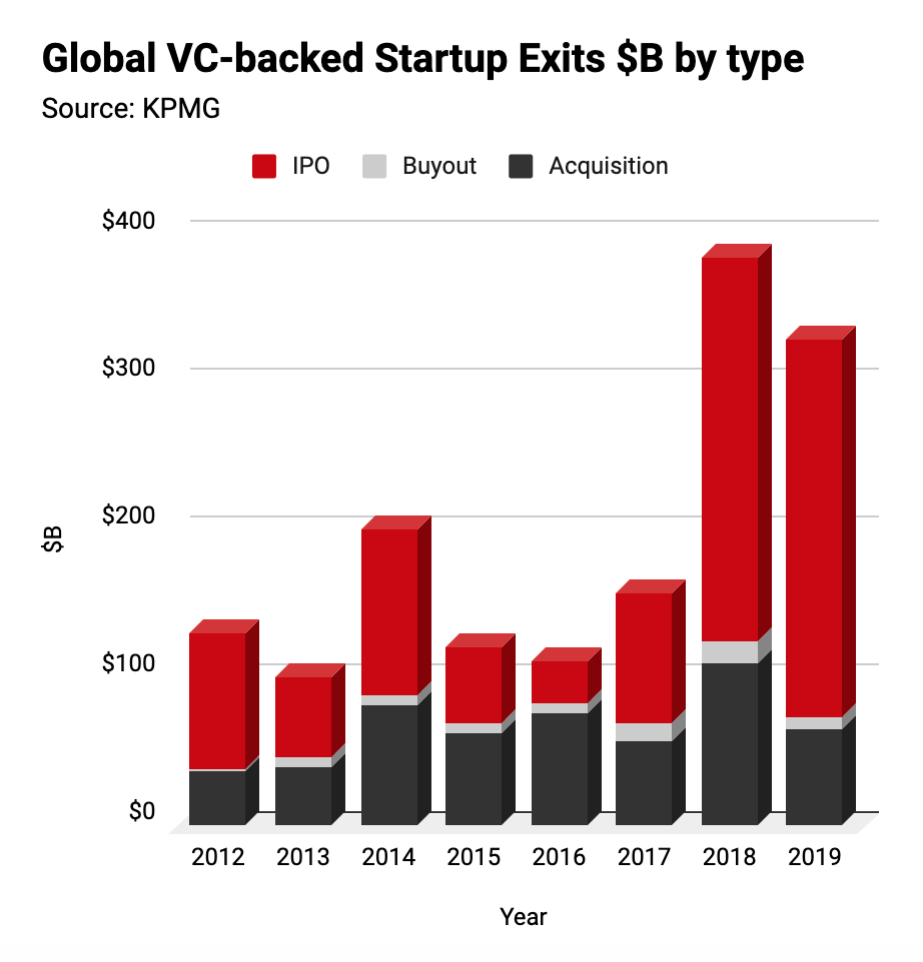

Defying well established historical trends, dating back decades, by mid-2019 and well before coronavirus, something changed. With consumer confidence at an all-time high and the Nasdaq index up by 35%, the number and value of exits started to decline, and it hasn’t stopped since. Why?

The 3rd and 4th quarters of 2019 saw a sequence of disappointing IPOs (Uber, Lyft, WeWork), adding increased scrutiny to business models and making investors more focused on the ability of a company to make a profit.

A second tipping point came after Uber split its financial reporting for five of its business segments. VCs began to ask for the same level of transparency from other companies with multiple revenue streams, thus determining whether companies could compete with others in specific areas. Companies unable to provide such a level of detail found it even more difficult to conduct a strong exit.

Although a shift in exit strategies was already in place, COVID-19 introduced additional complexity and uncertainty to the equation. A recent report shows that 90 percent of consumers across 42 countries expect COVID-19 to impact their personal routines for more than two months. A decline in consumer income, household spending intent and optimism about the country’s economic recovery shows that while nations around the world begin to reopen, consumers continue to feel the financial impact of the crisis.

With travel restrictions and several international events being cancelled, businesses operating in the travel and hospitality industry were hit hard. A case in point, Airbnb’s plead to go public “somewhere in 2020” remains undelivered. What was once seen as one of the IPOs of the year has swiftly turned sour with the announcement of sweeping layoffs.

The company is under pressure from its 6.000-person work force to go public as soon as November. Valued at $31 billion in 2017, employee equity is set to start expiring between November 2020 and in mid-2021. Those shares will become worthless if the company is not trading publicly by then, most likely at discount rates given the travel industry convalescence from the virus.

Although the current situation is likely to disrupt Airbnb’s plans for the IPO this year, and despite the recent massive layoffs, its CEO Brian Chesky hasn’t ruled out going public in 2020.

The bottom line? As a consequence of the reduced number of deals in Q1 2020, startup funding is expected to slow, as well as Venture-based exit activity is bound to decline in both volume and value for the last 2 quarters and it is expected to diminish further. Coronavirus contributed, but it is far from the only factor or the main reason behind this result. The root cause, starting back in 2019, is more likely a razor-sharp VC focus on scalability, profitability and transparency, caused by recent cautionary tales from companies such as Uber and Airbnb. Now, founders are bracing for fewer funding rounds, harsher terms and more down-to-earth exit valuations.

Coping with an uncertain environment - be ready and stay ready

Even Lemonade’s recent IPO - the best that FY 2020 has seen so far - has generated some skepticism. With so much uncertainty in the IPO market these days, preparation is key to ensuring that companies are primed to take advantage of favorable market conditions when they ultimately emerge. As ex-Eventbrite Brian Rothenberg recently said in an interview, “the key to sustaining startup growth is knowing how to evolve your strategy over time”. There is no “growth hack” - developing a growth strategy in uncertain times means betting on flexibility, always adapting to shifting circumstances.

However, from loneliness to constrained communication and collaboration, many are the challenges that fully remote companies are facing. Humans are social beings, if most people wanted to always work alone from home, coworking spaces wouldn’t exist. Following the latest pandemic-imposed remote framework, several studies have been conducted to gather data on workforce’s satisfaction with working from home. Most of these studies show that people want the possibility to choose whether to go to the office or work from home, valuing flexibility but not office-only or remote-only policies. In today’s competitive landscape, carefully planning the distribution of your teams means having access to a more diverse talent pool and increase operational resilience, preparing the foundation for future expansion, and fostering diversity.

That is why at BRIDGE IN we believe in a model of distributed hubs, allowing startups to be more cost-effective, to prepare for global operations and diversify the talent pool, all while ensuring good team collaboration and resilience for business continuity.

Our expertise in scaling tech startups together with our local partners’ network allows us to help you start your operations in Portugal and then expand to the European market.

For further information, sign up to our newsletter and follow us on Twitter and Linkedin.