Hiring a Team in Portugal: the Real Cost of Employment

Portugal has been heading international lists and ranking of most innovative countries for many years now, proving to be a top destination for companies willing to create a European hub of tech, business development and customer success teams. Great tech talent, high English proficiency, timezone compatibility, open working culture, affordable costs and excellent safety and stability conditions contribute to this effect, turning the country into a magnet for foreign investment.

Several companies have already set up their tech teams, dev centres and business development hubs here, some of them helped by BRIDGE IN. If you want to know more about why Portugal is a top tech destination, download our guide.

However, hiring workers in another country can have a significant impact on your business: you need to find the right people, comply with and respect the laws and consider the fixed monthly cost that hiring will entail. A foreign company willing to engage the services of the local workforce is not necessarily required to establish a local entity. Foreign companies can, in fact, engage the service of a local Employer of Record such as BRIDGE IN to act as an intermediary between the company and its local workers.

From a corporate perspective, and as a rule of thumb, if a company intends to employ local workforce and to carry out activities in the national territory for more than a year and employ more than a couple of contributors, then a local permanent representation should be considered, adopting the form of subsidiaries or branches. Whether a local legal entity is established - triggering or not the corporate fees and tax compliance - having employees working from Portugal with a local labour contract will, nevertheless, involve new procedures and obligations with regards to:

labour insurance;

social security benefits and contributions;

employee income tax issues;

statutory benefits

If you have questions regarding the establishment of a local legal entity, please download our detailed guide or get in touch with one of our experts.

Salaries in Portugal: how much should you pay your local team?

Despite the pandemic-fueled international crisis, the national minimum wage in Portugal rose a solid 7.8%, compared to 2022’s figures, to 760 € gross per month in 14 instalments. A report by the European Foundation for the Improvement of Living and Working Conditions (Eurofound), analyzing 22 countries, puts Portugal in 7th position for the biggest increase, following the Keynesian approach of encouraging spending in a time of economic recession.

Portugal still has the lowest minimum wage in Western Europe, and even though salaries for tech positions are way above the national minimum, setting up a software development team is significantly more affordable than in other western cities. In Portugal, it is still possible to have a well-located office with all the amenities and hire top talent for a third of what it would cost in major US cities and about half for some European cities.

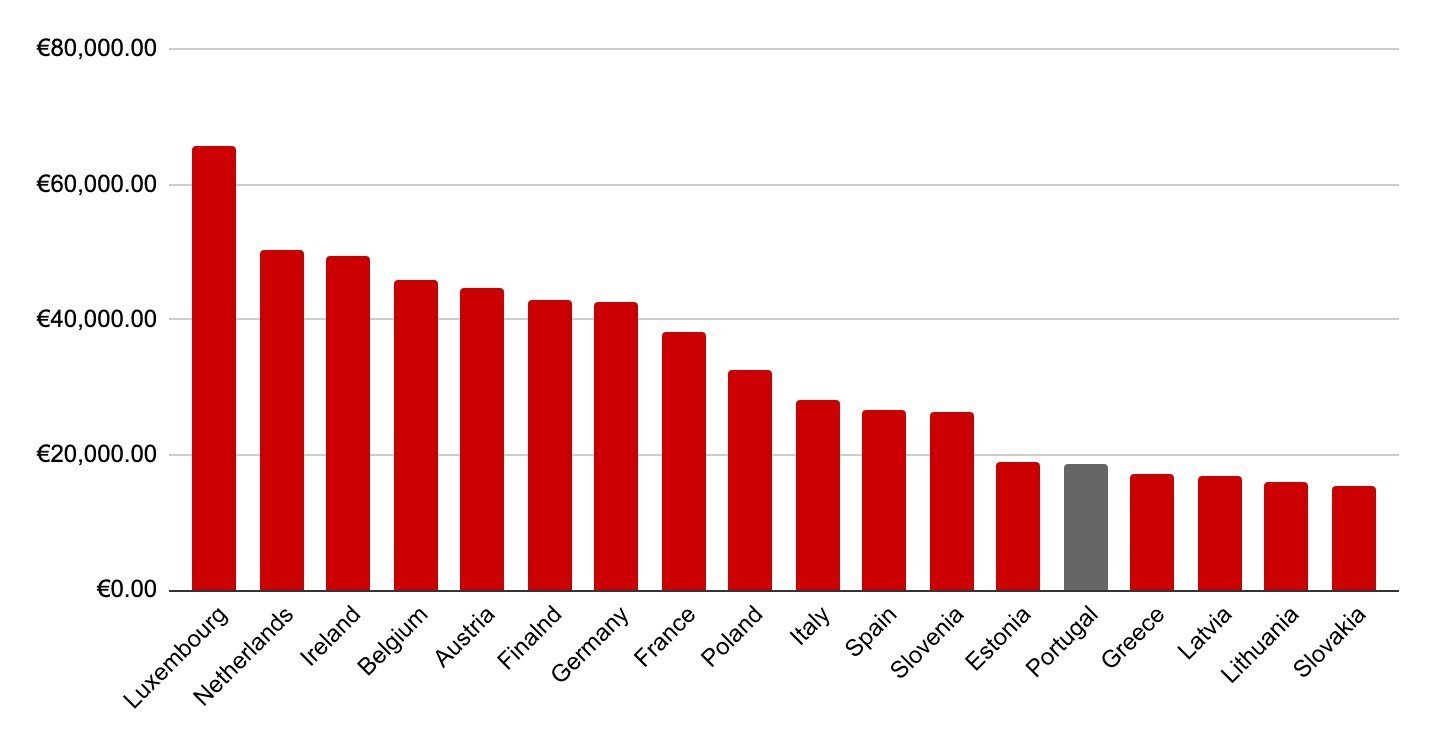

Average Salary in Europe - Source: Statista July 2021

Salaries in the IT sector tend to be higher than the national average: the sector, in Portugal as well as worldwide, is in fact one of the few areas in the economic countercycle, showing no sign of slowing down. The scarcity of talent, still far below demand, continues to make salary ranges change in Portugal.

According to figures from consultant Robert Walters, salaries for IT professionals continue to rise in 2021, a trend that has been visible over the past few years. Tech profiles in high demand include: data & analytics manager, DevOps engineer and cyber security manager. The table below shows the Gross Annual Salary in Lisbon for several tech positions based on candidate expertise and domain knowledge.

The Gross Annual Salary doesn’t include all Employment Costs, namely Social Security contributions. For information about the total cost of employment, please refer to the next sections of this blog post.

The Real Cost of Employment

Employee’s gross compensation and total cost of employment for the employer are two very different figures.

In fact, both the employee and the employer pay taxes based on the gross compensation. In addition to such taxes, the employer is subject to fulfil the obligations mentioned in the previous page regarding employees’ mandatory benefits.

BASE SALARY

The base salary, also known as gross or gross salary, is the main part of the costs that a company has with the worker. It is also based on this amount that other costs are calculated, such as the amount paid to Social Security. The gross remuneration is paid in 14 instalments (the 13th and 14th months - corresponding to holiday and Christmas allowances).

SINGLE SOCIAL TAX - SOCIAL SECURITY

The amount paid to Social Security is coming both from the employer and the employee, although for the latter the withholding is withdrawn from the monthly base salary.

In most situations, the contribution rates to be applied are shown in the following table:

Source: Social Security Official Website

WORKER’S COMPENSATION INSURANCE

Worker's Compensation Insurance is mandatory for any company, without exception. Bonuses vary depending on the risks implicit in the activity carried out by the worker.

On average, labour insurance premium is 1% of the income to be insured. This is, therefore, an important part to consider when calculating the total cost of an employee.

MEAL ALLOWANCE

The meal allowance is considered a social benefit and is paid by the vast majority of companies. It is not mandatory by law, depending on the collective labour agreement applicable, but it is usually paid as it is not subject to taxation, accordingly to the following rules:

If the meal allowance is paid in cash or bank transfer and does not exceed €6.00 per day, it is exempt from Social Security and IRS contributions

If the meal allowance is paid by a prepaid meal card, the maximum amount exempt from taxation is €9.60 per day.

Any amount exceeding the above-mentioned is subject to Social Security contributions and Personal Income Tax.

OTHER COSTS

In addition to the costs listed above, there are other mandatory costs related to the occupational health and safety audit, the employee yearly medical exam, and professional training (the employer must provide 40 hours of accredited training per year to each employee, or pay them the correspondent amount instead).

There are also other, non-statutory allowances and perks that employers can offer their employees such as:

Transport allowance;

School voucher;

Childcare voucher;

Health insurance;

Life insurance;

Work from Home allowance;

Technical equipment;

Gym pass;

Company car

Work from Home allowance (recommended and expected to be mandatory with the review of telecommuting regulations)

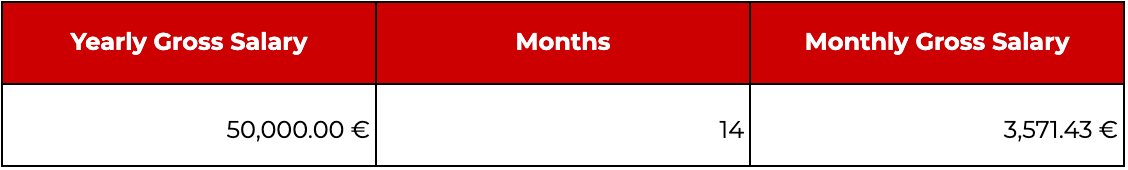

A Practical Case: 50K Base Salary Breakdown

For the purpose of this example, we will consider a gross annual salary of 50k€.

A base annual gross salary of 50k€ will mean a gross monthly salary of 3,571.43 €.

In Portugal, 14 monthly salaries should be processed, 12 months plus Holiday and Christmas Allowances

MEAL ALLOWANCE

Through a meal card (prepaid debit card) the employee can get a bigger allowance without it being subjected to taxes. The meal allowance is paid for every working day (11 months of the year). It is necessary to take into consideration the processing fees of the meal card provider. In this example we’ll consider a value of 6.83€ of meal allowance and a meal card provider that charges a fixed fee of 6.00€ + VAT per month, other providers charge a % of the processed amount.

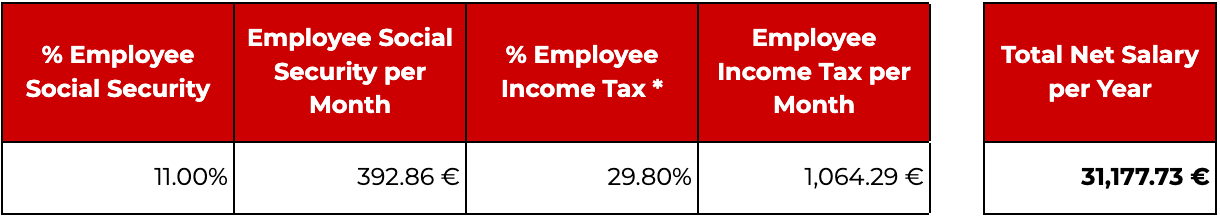

EMPLOYEE TAXATION

Portugal has a progressive income tax rate. Higher salaries are subjected to a higher % of tax. Civil status and the number of children affect the income tax rate.

Social Security tax includes a employee payment of 11% of gross compensation

Income Tax depends on marital status and number of dependents (children) - for the sake of this example, we are considering a married employee with a child

Net salary per month will vary in the months of July and November, where the Holiday and Christmas Allowances are usually added, respectively.

MANDATORY COMPANY BENEFITS

Social Security tax includes a company payment of 23.75% of employee’s gross compensation

Additional Compensation Funds of 1% need to be paid to Social Security Trust Fund

By Law there is a mandatory Medical Exam and Labour Insurance. Costs of Medical Exam will vary based on provider and completeness of exams to be performed. Labour Insurance premium is related to the gross salary and inherent risk of the profession. This example considers typical values for tech workers.

Employers are also required to provide training to employees or pay them instead

OTHER BENEFITS AND PERKS

Private Health Insurance is a common and recommended perk. Presented value can vary accordingly to age, and pre-existing health problems.

Communication Allowance is recommended for office-based employees and mandatory for remote employees working from home

Additional Perks are less common.

TOTAL COST OF EMPLOYMENT

The total cost of employment for a 50k€ gross annual salary, meeting legal obligations and mentioned benefits, allowances and perks is about 66.3k€

These hiring costs DO NOT include:

Laptop, smartphone, extra monitor, mouse or keyboard

Travel, Car or Fuel Allowances

Workplace (High speed internet, electricity, water, desk)

Additional perks such as: Gym, Spotify, Netflix, or Audible

Annual bonuses

For detailed information on the real cost of employment in Portugal, download our ebook.